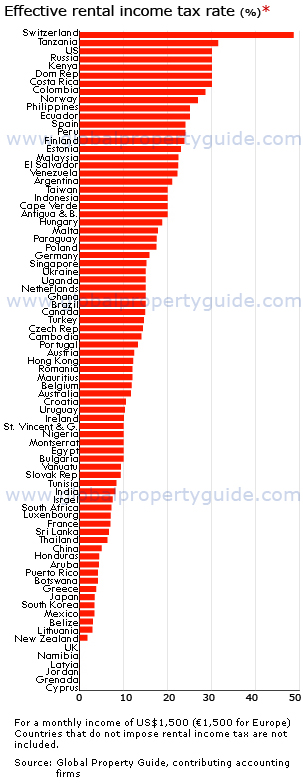

Second home and buy-to-let buyers sometimes have hazy ideas about how much they'll earn on their rental property abroad. Critical variables, such as income tax on rent, vary enormously from one country to another.

In Europe, the effective rate of rental income tax, payable by non-resid ent owners on a €1,500 monthly rental income, varies from 48.56% in Switzerland to 0% in Cyprus.

In Latvia there is a flat tax rate of 25% on income. But landlords can depreciate their purchasing costs, reducing effective taxes to zero, at least during the initial ownership years.

The importance of deductions is also highlighted in the case of France. The nominal income tax rate for non-residents is high at 25%. However, if the gross rental income on a furnished flat is less that €76,300 per annum, deductions of up to 72% can be made. Only the remaining 28% of gross income is taxed, amounting to an effective tax rate of only 7%.

And in the UK, personal deductions combined with depreciation and costs are already higher than the gross income of €1,500 per month (€18,000 per year), leading to zero taxable income.

Rental income tax assumptions

The Global Property Guide's estimate of the 'effective' tax rate includes adjustment for depreciation, and any other typical costs which a landlord pays such as management charges, buildings insurance, real estate agency fees, real estate taxes, etc. However, mortgage expense tax relief is not included.

To make the income tax situation easy to understand, the study adopts a standard case:

- Gross rental income is US$1,500/month, or US$18,000 per year (€1,500 or €18,000 for Europe).

- The property is directly jointly owned by husband and wife, who are both foreigners and non-residents. Many countries impose higher taxes on foreigners and/or non-residents, or allow them lower deductions.

- The owners have no other local income, aside from rent.

- There is no mortgage, i.e., no loan was taken to buy the rental unit1.

The result is an 'effective income tax rate', which is typically different from the nominal tax rate. These effective rates represent what taxes are really payable, after all allowances and deductions. They provide a clearer and more realistic picture of a country's tax situation for potential investors.

Europe

Switzerland imposes the highest rental income taxes in Europe. The effective income tax rate can go as high as 54.5% on monthly rental income of €12,000/month.

Russia imposes a flat 30% tax on the gross rental income of non-residents, without any deductions allowed.

Other countries with effective income tax rates exceeding 20% include Norway, Spain, Finland and Estonia.

Effective rental income taxes are generally low in Luxembourg, France, Lithuania and the UK, while Monaco does not impose any income taxes.

EUROPE: EFFECTIVE RENTAL INCOME TAX RATES(%) | ||||

| COUNTRY | MONTHLY RENTAL INCOME (€) | CONTRIBUTOR* | ||

| 1,500 | 6,000 | 12,000 | ||

| Switzerland (Geneva) | 48.56 | 53.02 | 54.48 | PWC |

| Russia | 30.00 | 30.00 | 30.00 | Ernst & Young, PWC |

| Norway | 26.86 | 30.00 | 31.07 | Grant Thornton |

| Spain | 24.00 | 24.00 | 24.00 | Grant Thornton |

| Finland | 23.80 | 23.80 | 23.80 | KPMG |

| Estonia | 23.00 | 23.00 | 23.00 | Global Property Guide |

| Hungary | 18.72 | 29.57 | 32.78 | Mazars |

| Malta | 17.78 | 25.45 | 26.72 | AGN |

| Poland | 17.44 | 19.36 | 19.68 | TGC Corporate Lawyers |

| Germany | 15.82 | 17.12 | 17.56 | Grant Thornton |

| Netherlands | 15.00 | 17.25 | 20.00 | PWC |

| Ukraine | 15.00 | 15.00 | 15.00 | Grant Thornton |

| Turkey | 14.61 | 21.70 | 24.80 | Moore Stephens |

| Czech Republic | 14.36 | 22.79 | 24.20 | BDO/ KPMG |

| Portugal | 13.25 | 13.11 | 13.11 | PWC |

| Austria | 12.38 | 18.21 | 20.51 | Ginthoer & Partner |

| Romania | 12.00 | 12.00 | 12.00 | Grant Thornton |

| Belgium | 11.78 | 15.10 | 21.17 | BDO |

| Croatia | 10.50 | 10.50 | 10.50 | TPA Horwath |

| Ireland | 10.05 | 11.54 | 13.86 | Grant Thornton |

| Bulgaria | 10.00 | 10.00 | 10.00 | Grant Thornton |

| Slovak Republic | 9.30 | 13.00 | 13.60 | PWC |

| Luxembourg | 7.02 | 9.17 | - | Moore Stephens |

| France | 7.00 | 7.00 | 7.00 | Anthony & Cie, Stephen Smith |

| Greece | 3.75 | 15.56 | 22.78 | Prooptiki/ Deloitte |

| Lithuania | 2.90 | 4.26 | 4.92 | PWC |

| Cyprus | 0.00 | 6.70 | 19.46 | Anthony Ashiotis & Co. |

| United Kingdom | 0.00 | 9.21 | 11.98 | Grant Thornton |

| Latvia | 0.00 | 0.00 | 0.00 | Solvo |

| Monaco | no rental income tax | Global Property Guide | ||

| Source: Global Property Guide | ||||

Asia-Pacific

In the Asia-Pacific, the Philippines, Malaysia, Indonesia and Taiwan impose the highest rental income taxes. In the Philippines, a flat 25% tax is imposed on the gross rental income of non-resident foreigners; in Indonesia and Taiwan, a fixed 20% tax.

Malaysia, on the other hand, imposes a 28% tax on net rental income. With costs deducted from the gross income, effective rental income tax is around 22% to 25%.

In India, although effective rental income tax is just 8.1% for a monthly income of US$1,500, the rate climbs steeply to 19.3% and 21.1% for monthly incomes of US$6,000 and US$12,000, respectively. Similar steep progressive taxes are also observed in Sri Lanka and Thailand.

Effective rental income tax rates are generally below 10% in China (Shanghai), Japan, South Korea and New Zealand.

ASIA- PACIFIC: EFFECTIVE RENTAL INCOME TAX RATES (%) | ||||

| COUNTRY | MONTHLY RENTAL INCOME (US$) | CONTRIBUTOR* | ||

| 1,500 | 6,000 | 12,000 | ||

| Philippines | 25.00 | 25.00 | 25.00 | Grant Thornton |

| Malaysia | 22.42 | 25.09 | - | Ahmad Abdullah & Goh |

| Indonesia | 20.00 | 20.00 | 20.00 | PWC |

| Taiwan | 20.00 | 20.00 | 20.00 | Grant Thornton |

| Singapore | 15.13 | 15.13 | 15.13 | Grant Thornton |

| Cambodia | 14.00 | 14.00 | 14.00 | Global Property Guide |

| Hong Kong | 12.16 | 12.16 | 12.16 | Grant Thornton |

| Australia | 11.63 | - | - | Deloitte |

| Vanuatu | 9.38 | 9.38 | 9.38 | BDO/ KPMG/ CK |

| India | 8.11 | 19.33 | 21.07 | Grant Thornton |

| Sri Lanka | 6.62 | 19.61 | 22.86 | Grant Thornton |

| Thailand | 6.30 | 12.71 | 15.81 | Grant Thornton |

| China (Shanghai) | 5.00 | 5.00 | 5.00 | Grant Thornton |

| Japan | 3.40 | 5.88 | 5.88 | Grant Thornton |

| South Korea | 3.38 | - | - | Grant Thornton |

| New Zealand | 1.74 | 9.61 | 10.40 | Grant Thornton |

| Source: Global Property Guide | ||||

Americas and the Caribbean

While most of the Caribbean is known for its tax havens, the rest of the Americas impose hefty taxes on the rental income of non-resident foreigners.

Mexico and Ecuador charge a fixed 25% tax on gross rental income, while Peru imposes 24%. Other countries with effective tax rates typically beyond 20% include El Salvador, Venezuela, Argentina, and Antigua and Barbuda.

In Canada and the US, non-resident landlords are given the option to choose between paying 'gross' and 'net' income tax. The gross income tax is high but the process is very simple. In the US, the gross rental income of non-resident aliens (NRA) that are 'not effectively connected' is taxed at 30%, withheld by the tenant. In Canada, gross income is subject to a fixed 25% tax, withheld by the tenant.

Landlords can alternatively opt to pay net income after allowed deductions, potentially lowering tax rates, but the rules are complicated. In Canada, by 'electing under section 216' the net income is taxed at rates ranging from 15.5% to 29%. Maintenance, local taxes and depreciation are deductible subject to certain rules. The final effective tax rates range from 8.14% to 14.87%, much lower than the 25% gross rate.

At the other end of the spectrum are the tax havens - countries and territories without income taxes: Anguilla, Bahamas, Bermuda, BVI, Cayman Is., St Kitts and Nevis and Turks and Caicos Is.

Effective rental income taxes for non-resident foreigners are typically below 10% in Honduras, Aruba, Puerto Rico, Belize and Grenada.

Middle East and Africa

In Africa, the effective rental income tax is highest in Tanzania and Kenya at 31.45% and 30%, respectively. Cape Verde charges a fixed 20% tax on gross rental income; while Ghana and Uganda charge 15%.

In Egypt, rental income tax is 20%. The maximum deduction allowed to cover operating expenses is 50% of the gross rent, leading to an effective rate of 10%. In Nigeria, gross rental income of non-residents is taxed at a final withholding rate of 10%.

Countries in the Middle East with no income taxes include Bahrain, Oman, Saudi Arabia and UAE. Effective rental income tax in Israel, Namibia and Jordan are typically below 10%.

MIDDLE EAST & AFRICA: EFFECTIVE RENTAL INCOME TAX RATES (%) | ||||

| COUNTRY | MONTHLY RENTAL INCOME (US$) | CONTRIBUTOR* | ||

| 1,500 | 6,000 | 12,000 | ||

| Tanzania | 31.45 | 31.45 | 31.45 | Grant Thornton |

| Kenya | 30.00 | 30.00 | 30.00 | AM Shah & Sons |

| Cape Verde | 20.00 | 20.00 | 20.00 | Global Property Guide |

| Ghana | 15.00 | 15.00 | 15.00 | PKF |

| Uganda | 15.00 | 15.00 | 15.00 | Global Property Guide |

| Mauritius | 12.00 | 16.70 | 17.37 | Kross Border Trust Services |

| Egypt | 10.00 | 10.00 | 10.00 | Moore Stephens Khodeir |

| Nigeria | 10.00 | 10.00 | 10.00 | Muyiwa Bunmi Ogunlea & Co. |

| Tunisia | 8.32 | 14.91 | 17.66 | Lassad Marwani & Co. |

| Israel | 7.50 | 7.50 | 7.50 | Grant Thornton |

| South Africa | 7.23 | 15.78 | 20.10 | Nexia International |

| Botswana | 4.17 | 15.50 | 19.80 | AGN Dobson & Co. |

| Namibia | 0.00 | 6.40 | 8.00 | Grant Thornton |

| Jordan | 0.00 | 1.93 | 5.01 | Grant Thornton |

| Bahrain | no rental income tax | Global Property Guide | ||

| Oman | no rental income tax | Global Property Guide | ||

| Saudi Arabia | no rental income tax | Grant Thornton | ||

| United Arab Emirates | no rental income tax | Grant Thornton | ||

| Reunion Is. | tax system similar to France | Global Property Guide | ||

| Source: Global Property Guide | ||||

Social effects

Higher marginal taxes on rental properties are argued to be pro-poor, because of the perception that landlords and property owners are typically rich, thus should be taxed more. The perception is amplified when taxing non-resident foreigners.

However, excessive taxation of rental property affects the availability of affordable housing, as shown by much research. High taxes on rental income lead to low net rental yields, which discourage owners from renting out their properties.

And due to the filtering effect, any policy that makes it difficult or expensive to produce any type of housing restricts the available stock of low-cost housing. The filtering effect is a process wherein poorer households move to occupy the void left by richer households as they move from renting to ownership or to better and newer housing.

Spain's high rental income tax rate of 24%, for instance, combined with restrictive tenancy laws, has led to the shrinking of the private rental market. Property owners prefer to keep their housing units empty rather than rent them out. In 2001, about 14% of the total housing stock was vacant, more than the entire rental stock (which was only 10% of the housing stock).

From an investor's point of view, the significant difference between nominal and effective tax rates in several countries highlights the importance of tax planning. Knowing all the legally allowable deductions and allowances can spell the difference between profits and losses, and separate gainers from losers.

Footnote:

1 The term 'income tax', in a broad sense, refers to 'any tax levied, proportionately to the amount of income received by the owner for letting property'.

The typical value for the apartment is based on the Global Property Guide's valuation research, and depreciates on this basis. If there are significant variations in local taxes, we take the tax scenario for the country's 'premier' city (e.g., Geneva in Switzerland).

* DISCLAIMER: The information contained here is not written tax advice directed at the particular facts and circumstances of any person and should not be relied upon. We encourage you to discuss your particular situation with the particular accounting firm or an independent tax advisor.