Globally, we are witnessing the biggest and most extensive house price boom in recorded history, both in terms of the number of countries experiencing real house price gains, and the number of successive years that house prices have been rising.

However, while property in much of the developed world is at historic peaks, property prices in most Asian countries are well below peak levels. Here, the Global Property Guide explores why.

Essentially property prices in Asia have lagged for three reasons:

- The Asian Crisis caused a long period of high interest rates, and an economic slowdown, which slowed the growth of the mortgage and real estate markets.

- Post-crisis loan portfolios were full of defaulted property loans. It took a long time before banks regained the capacity to lend at pre-crisis rates.

- Poor credit information, weak legal systems, lack of transparency, high revenue extraction by governments in the form transfer taxes and of registration fees, all raise the costs of housing, and discourage lending and housing investment in some countries.

The Asian crisis caused an interruption in banks making mortgage loans available to borrowers at anything near acceptable interest rates and a reduction in the willingness of the banks to lend. When this period came to an end, at different times in different countries, the fizz returned to Asian housing markets.

Demand is now growing strongly, and developers are racing to meet supply, though rising global interest rates have recently somewhat dampened the euphoria.

The global house price boom

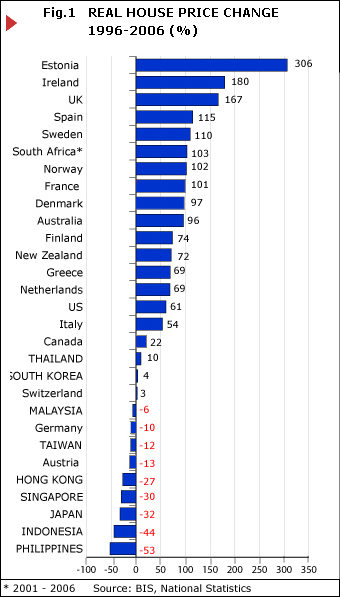

Among the 40 countries monitored by the Global Property Guide, European countries are at the forefront of the global house price boom (Figure 1). House prices in Estonia rose by 300% from 1996 to 2006, in real terms, Ireland by 180% and UK by 167%. Other countries that experienced doubling of prices include Spain, Sweden, Norway and France.

Outside Europe, countries participating in the boom include Australia, New Zealand, the US, and South Africa.

While much of the developed world is experiencing house price booms, much of Asia is down. Property prices in the Philippines dropped by 53% in real terms from 1996 to 2006. Residential real estate prices in East Asian countries peaked in early to mid-1990s at the onset of the Asian crisis.

Mortgages and house prices

House price booms are typically accompanied by mortgage market booms. There is a strong link between mortgage growth and house price rises.

- Lower mortgage rates increase bank credit to homebuyers. This boosts demand and raises house prices.

- Lower interest rates encourage households and firms to invest and consume more, boosting economic growth, indirectly translating to higher wages and lower unemployment, which in turn boosts demand for housing.

- Increases in property values imply a lower default probability for mortgage loans, so that banks are more willing to extend new credit for home purchases and new construction, and even to other sectors if housing or land is used as collateral.

- Finally, changes in economic or monetary conditions tend to cause house prices and mortgage lending to move in the same direction.

As observed in countries experiencing housing and mortgage booms, economic conditions conducive to the growth of mortgage market include:

- Low and stable inflation, which in turn leads to lower nominal interest rates.

- Housing market liberalization, including the privatization of social housing and removal of rent control and tenant security. This was observed in transition countries in eastern and central Europe.

- Mortgage market liberalization. Mortgage market reforms have notably taken place in Spain, Ireland, Estonia, and South Africa. Liberalization typically includes the privatization of specialized mortgage banks and removal or relaxation of credit restrictions. Foreign banks and mortgage originators are allowed to enter the market to increase competition and funding.

- Issuance of asset backed securities such as mortgage backed securities, which increase the amount of funds available for mortgage lending, and enabled the development of different types of housing finance products, longer loan terms, and higher loan to value ratios.

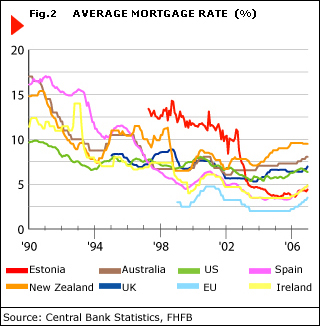

Mortgage rates have fallen to historic lows in most boom countries. In the Euro zone, mortgage rates have tended to converge and moved in the same direction with the adoption of the Euro (Figure 2). Most EU mortgage rates are based on the European Central Bank's repo rate. Set at 2% in June 2003, it has remained unchanged for 31 months.

Adjustable vs. Fixed rate mortgages

There are two basic types of mortgages in terms of interest rate adjustment: fixed rate mortgages (FRMs), and adjustable rate mortgages (ARMs).

In most developed countries, different packages are available to borrowers, combining the different attributes of FRMs and ARMs. There are hybrid-ARMs where the interest rate is fixed for 1 to 5 years, and is then adjustable. Mortgages with interest rates fixed for more than five years are regarded as FRMs.

So, why do certain households and countries prefer adjustable over fixed rate mortgages?

Given the complexity of mortgages and uncertainty about the future, most households tend to focus on the immediate monthly mortgage cost, highlighting the importance of low nominal mortgage rates. The interest rate difference between ARMs and FRMs can thus be important. If interest rates are historically low, the apparent savings with ARMs may be large, and more households are likely to take the interest rate risk. And if mortgage rates have been consistently falling or stable in the past, households might expect mortgage rates to fall further or remain low in the future.

But borrowers are also greatly influenced by advice given by experts, i.e., by the lenders themselves. Most borrowers take at face value the professional advice given by banks and mortgage lenders.

So what determines what mortgages the lenders prefer to offer?

Government regulation can be important. In most countries, regulators limit the amount of risks lenders can take. But even more important is the lenders' funding source. Lenders typically offer ARMs if their main source of funding is based on short-term interest rates, such as bank deposits.

Countries which primarily rely on fixed rate mortgage products include the US, Canada, and Continental Europe, where bonds and asset-backed securities are the main funding source. On the other hand, those that rely predominantly on adjustable rate mortgages include the UK, Ireland, Estonia and other leaders of the house price boom, where funding is based on short-term interest rates, such as bank deposits.

Conversely, because of the more direct relationship between interest rates and house price changes, ARM-based countries are at a bigger risk of house price slowdowns or downturns when interest rates increase. They are also more prone to property speculation.

Limited mortgage options in Asia

In Asia, despite the prevalence of adjustable rate mortgages there are no continuous and rapid house price changes. High interest rates caused by the Asian crisis have dampened the market.

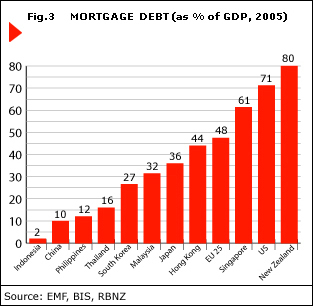

Mortgage markets of Asian countries are also relatively small. Only Singapore and Hong Kong have mortgage markets generally at par with most developed countries, with mortgage debts at 61% and 48% of GDP, respectively. Mortgage markets are particularly small in Indonesia, China, Philippines and Thailand (Figure 3). Even OECD member countries Japan and South Korea have relatively small mortgage markets given their level of economic development.

Looking at basic mortgage market indicators (Table 1), the maximum loan to value ratio for new loans in most Asian countries is either 70 or 80%, with maximum loan terms of 20 to 30 years. However, actual loan terms and LTV ratios of approved loans are much lower.

TABLE 1. MORTGAGE MARKET INDICATORS | |||

| COUNTRY | MAX LTV RATIO NEW LOANS (%) | TYPICAL LOAN TERM (YEARS) | MORTGAGE RATE* |

| China | 80 | 10 - 15 (max 30) | ARM |

| Hong Kong | 70 | 20 | ARM |

| Indonesia | 80 | 15 (max 20) | ARM |

| Japan | 80 | 20 - 30 | ARM |

| Malaysia | 80 | 30 | ARM |

| Philippines | 70 | 10 - 20 | ARM |

| Singapore | 80 | 30 - 35 | ARM |

| South Korea | 70 | 3 - 20 | ARM |

| Thailand | 80 | 10 - 20 (max 30) | ARM |

| *Typically fixed for 1 to 5 years, then float. Source: BIS, OECD, HKMA, HMF | |||

Most housing loans are hybrid adjustable rate mortgages, typically fixed for one to three years, because banks are the main providers of mortgages in Asia. In Indonesia, most mortgage rates are fixed for only 6 months. In Japan, the most common mortgage package has fixed interest rates for 3 years, and then, adjusted semi-annually.

Mortgage rates for ARMs offered by commercial banks are generally affordable, at interest rates below 8% in most Asian countries (Table 2). Exceptions are the Philippines and Indonesia, which have the highest and most unstable inflation among the countries under consideration.

Borrowers have limited options since most banks in Asia do not offer mortgages with interest rates fixed for more than 5 years. Ten-year fixed rate mortgages are available from the biggest banks in the Philippines, but at prohibitive rates. Even banks in Singapore do not offer FRMs. Long term fixed rate mortgages were offered in Hong Kong in 2004 but were received coolly by the market due to falling interest rates.

TABLE 2. MORTGAGE RATES | ||

| COUNTRY | ADJUSTABLE (FIXED FOR 1-5 YRS, THEN FLOAT) | FIXED (5 YRS OR MORE) |

| China | 5.355 - 5.508 | 5.81 |

| Hong Kong | 5.25 | .. |

| Indonesia | 10.98 - 14.99 | .. |

| Japan | 1.675 - 2.9 | 2.4 - 3.15 |

| Malaysia | 1.50 - 5.90 | .. |

| Philippines | 9.00 - 9.99 | 10.99 - 11.50 |

| Singapore | 3.25 - 4.25 | 4.50 - 5.50 |

| South Korea | 6.01 - 6.51 | .. |

| Thailand | 5.00 - 7.75 | .. |

| *Based on private commercial banks (data as of Feb 2007) Source: various banks in each country | ||

China's mortgage market was liberalized only in 2005, partly explaining why its size is small. Despite the liberalization, Chinese banks do not price loans in terms of costs and risks, but give discounts up to 15% on the benchmark one year loan lending rate set by the People's Bank of China.

TABLE 3. BASE RATE FOR ADJUSTABLE-RATE MORTGAGES | ||

| China | People's Bank of China Loan Rate | |

| Hong Kong | Best Lending Rate or HIBOR | |

| Indonesia | Bank of Indonesia Rate (consumer loans) | |

| Japan | Home Mortgage Base Rate | |

| Malaysia | Base Lending Rate | |

| Philippines | Treasury Bill Rate | |

| Singapore | Mortgage Financing Rate | |

| South Korea | 91-day Certificates of Deposit (CD) yields | |

| Thailand | Minimum Loan Rate or Minimum Retail Rate | |

| Source: various banks in each country | ||

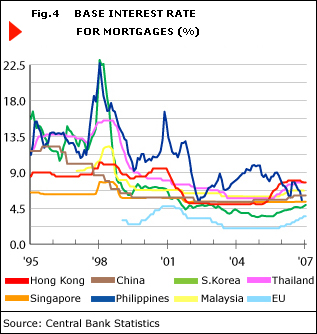

Base interest rates for mortgages (presented in Table 3) rose rapidly during the Asian Crisis (Figure 4). They gradually went down, and there was then a period of interest rate stability between 2003 and 2005. However, when global interest rates started rising, rapid and continuous interest rate hikes were observed in the region.

Asian interest rates have been high and highly volatile, except in Singapore. Compare the situation to the EU, where interest rates have recently been low and very stable.

Arguably, were it not for the institutional preference for FRMs in most European countries, it is likely that households would prefer ARMs, and indeed there is evidence of a 'creep' towards ARMs. On the other hand in most of Asia, households take ARMs simply because they have no choice and this has generally meant both a high interest rate, and also an uncertain and volatile interest rate.

Asian crisis and real estate

Before the crisis erupted in late 1997, there was a large amount of investment in real estate across the region, in an atmosphere of general economic euphoria. Property prices rose rapidly, and cities were full of new projects. Post-crisis, the very high interest rates caused most real estate loans to default, and many construction projects were halted. A lot of luxury and mid-level condominium units stayed unoccupied. Property prices stagnated or fell.

The high level of NPLs is indicated below (Figure 5). Cleaning the loan portfolio of bad assets was necessary before banks could issue new loans. As late as 2005 the NPL ratio still remained quite high in several Asian economies. It is only relatively recently that the situation has normalized, and the data for 2006 shows NPL ratios below 5% in most Asian countries.

Property prices fell by 20 to 50% in most countries in real terms between 1997 and 2003 (Figure 6). The real estate market started to recover first in Thailand, Malaysia and South Korea. By 2006, prices in these countries were at the same level as they were in 1995, in real terms.

Late comers to the recovery were Hong Kong, Singapore, and the Philippines. The recovery of Hong Kong was disrupted by the rise in interest rates, and Thailand's political uncertainty has adversely affected the real estate market.

In Indonesia, inflation, the bombings in Bali and Jakarta, the Asian tsunami, typhoons, earthquakes, volcanic eruption and flooding have all affected the market.

With the recovery of Asia's economies and real estate markets, Asia's primary mortgage markets have also expanded because of:

- Strong economic growth and low interest rates

- Financial and banking reforms

- Increases in capital and consolidation of banks

- Increases in foreign ownership and participation

- Decline in state ownership of banks

- The shift of government housing agencies to mortgage market 'enabler' instead of direct providers of mortgage loans has paved the way for the expansion of the private sector

- Most countries have also started to offer mortgage default insurance for lenders

However, a lot of challenges still confront Asia's housing markets. One factor is that housing in Asia is relatively expensive.

A 35 sq. m. condominium unit in the city center costs around 6 to 30 times the annual average income in most Asian cities (Table 4). Ratios between 3 and 5 are regarded as affordable.

TABLE 4. CONDOMINIUM AFFORDABILITY IN ASIAN CITIES* | ||||

| CITY | INCOME PER CAPITA (US$)* | CONDOMINIUM PRICE PER SQ M (US$)** | CONDOMINIUM PRICE (US$)*** | PRICE TO INCOME RATIO**** |

| Kuala Lumpur | 6,991 | 1,222 | 42,770 | 6.1 |

| Tokyo | 45,425 | 8,000 | 280,000 | 6.2 |

| Taipei | 13,036 | 2,330 | 81,550 | 6.3 |

| Hong Kong | 27,670 | 5,998 | 209,930 | 7.6 |

| Singapore | 28,578 | 6,700 | 234,500 | 8.2 |

| Bangkok | 6,317 | 1,667 | 58,345 | 9.2 |

| Seoul | 10,305 | 3,300 | 115,500 | 11.2 |

| Manila | 2,217 | 1,300 | 45,500 | 20.5 |

| Jakarta | 1,861 | 1,250 | 43,750 | 23.5 |

| Shanghai | 2,474 | 2,200 | 77,000 | 31.1 |

| Note: The figures represented here are only indicative and is not meant to be authoritative. *Data from World Bank, 2006 **Prices for 2006, data from Global Property Guide, ***Assuming a 35-sq m condominium unit in city centre ****Condominium price divided by income per capita | ||||

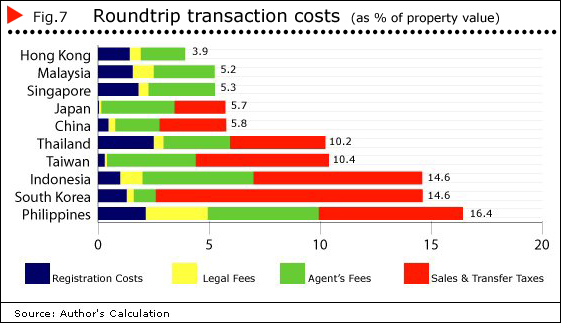

There are structural reasons for these high costs. Roundtrip transaction costs are high in several Asian countries, exceeding 10% of property values in the Philippines, South Korea, Indonesia, Taiwan and Thailand (Figure 7). In these countries, the bulk of the costs are accounted for by real estate agent's fees and sales and transfer taxes. It is worth noting that countries with the lowest transaction costs do not charge additional taxes on top of registration fees. Low transaction costs can stimulate market turnover and enhance the responsiveness of housing markets to macroeconomic stimuli.

In addition, the mortgage and real estate markets are still crippled by excessive government intervention.

Foreign ownership limits on banks, corporations and real estate restricts the amount of funding available and the level of competition, leading to inefficiencies.

- Price caps and anti-speculative measures implemented by China and South Korea to cool the housing market have unintended long term effects. They discourage owners and developers from selling properties, leading to less supply and more expensive real estate units.

- Excessive building and zonal restrictions limit supply, leading to unaffordable housing.

- Registering property is also unnecessarily tedious in several Asian countries. For example, there are 8 procedures to register property in the Philippines which can be completed in about 33 days, while it takes 143 days to complete the 4 procedures in Malaysia.

There are also specific structural challenges. Inadequate information, for instance, is a hindrance. Several countries still lack uniform national standards for property valuation and mortgage registration. In the Philippines, for instance, there are at least 23 government agencies undertaking real property appraisal, using their own system and methodology.

Credit risks remain high due to the insufficient credit information and credit management mechanisms. The establishment of credit rating bureaus and sharing of credit information can enhance the mortgage market. Real estate data are typically limited to major cities. The house price indices of several countries have limited scope and are not regularly updated.

The huge informal sector in Asia often leads to ill-targeted housing programs. Given a large informal labor market, housing finance systems remain inaccessible to the majority of the population. In Indonesia, 74% of the labor force does not earn documented and stable wages. In the Philippines, the need to show income tax return to secure loans limits potential applicants to just 6 million out of 55 million.

Conclusion

Asia missed the house price boom because of the Asian crisis. The crisis caused high interest rates, an economic slowdown, and a property crash, reducing consumer willingness to take on housing debt. High default rates in portfolios discouraged banks from lending. So in the worst affected markets, there was neither supply nor demand for mortgages.

Now signs of change are everywhere. Asia's property markets are now growing, and banks are willing lenders of mortgage loans around the region. In some countries, the long period during which loans were effectively unavailable means that supply is low, and rents are relatively high, leading to good rental investment returns for investors.

The worry is all in the other direction will Asia's housing market heat up too much?

There are still structural challenges hounding Asia's real estate and mortgage markets. Yet almost a decade after the Asian crisis, the enormous potential of the Asian housing markets, their size, population, rate of economic growth and urbanization, are ripe for the picking.