Northern European countries saw the highest house price rises in 2006, among the 40 countries monitored by the Global Property Guide (which maintains the world's single biggest collection of house price indices).

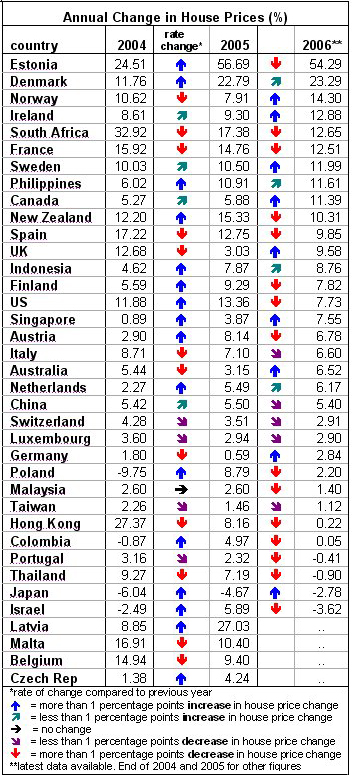

Leading the charge was Estonia with an impressive 54% house price increase in 2006. This followed average dwelling price rises of 57% in 2005, and 25% in 2004 (see table).

Estonia was followed by Denmark which experienced 23% house price rises in 2006, then by Norway (14%) and Ireland (13%). Other countries in northern Europe also had impressive house price increases, including Sweden, UK, and Finland.

Estonia was followed by Denmark which experienced 23% house price rises in 2006, then by Norway (14%) and Ireland (13%). Other countries in northern Europe also had impressive house price increases, including Sweden, UK, and Finland.

Early indicators suggest that Latvia's strong house price growth will continue in 2006, following 27% house price rises in 2005. This will be verified as soon as official statistics come in.

Outside Europe, South Africa, 2004's star performer, continues to experience strong house price growth, with 2006 house price rises of 12.7%. However, this is a far cry from the 33% increases recorded in 2004, and the 17% rises of 2005.

Countries attracting immigrants are also experiencing strong property price increases, particularly Canada (11%), New Zealand (10%) and, to a certain extent, the US (8%) and Australia (6.5%).

Central Europe lags behind

Southern Europe, the favorite destination of second home buyers and holidaymakers, is also experiencing strong house price increases.

France experienced a 12.5% house price increase from 3Q 2005 to 3Q 2006, while Spain registered a 10% rise in 2006 and Italy 6.6%. However property prices in Portugal dipped marginally (-0.4%), following a lacklustre recent past.

Austria's housing renaissance continued, with 6.8% price increases in Vienna, after 8% price rises during 2005.

Most countries in Central Europe, however, remained unexciting. 2006 saw very small price increases in Switzerland (2.9%), Luxembourg (2.9%), Germany (2.8%) and Poland (2.2%).

Philippines leads Asia

The Philippine real estate market registered the highest price growth in Asia during 2006 at 11.6% (Philippine property prices had dropped most after the 1997 Asian Crisis).

Indonesia's house prices rose 8.76%, from 3Q 2005 to 3Q 2006. However Indonesian inflation was high in 2006 at 13%, so in real terms Indonesian house prices actually fell.

Singapore's residential property price index rose 7.6% y-o-y to 3Q 2006, the city state's highest price increase since 2000.

Malaysia and Taiwan are still muddling through, and saw only marginal price increases of 1.4% and 1.1%, respectively.

The previous strong house price growth in Thailand during 2004 and 2005 came to an end, as the political crisis spilled over to the economy, and 2006 saw house price falls of almost 1%.

Japan has not seen the end of more than a decade of property price falls. Commercial property values are rising in Tokyo and some major cities, but in the rest of the country property prices are still static.

The global property boom is slowing

Many more countries experienced nominal house price increases in 2006, than price falls. Yet the pace of housing price increases in 2006 was generally down on 2005.

Several countries experienced quite significant slowdowns in their housing markets, without seeing actual price falls. Countries in this category, where the price rise rate dropped by more than five percentage points, include Poland (6.6 percentage point reduction on previous rate of house price rise), US (5.6% reduction on previous rate of house price increase) and New Zealand (5.02% reduction on 2005's price-rise rate).

However, US house prices showed no actual decline in 2006, either during the year, or from one quarter to the next, according to the OFHEO house price index, despite some press reports to the contrary.

It is tempting to attribute the slowdown in many countries to interest rate rises, especially in Europe and the US.

However, other forces came into play in some countries. Israel (typically not included in most 'global' house price reports) experienced price declines in 2006 (-4%), after a recovery in 2005. The price fall can be attributed to the war with Hezbollah in Lebanon, and other political troubles.

The dramatic upsurge of Hong Kong property prices in 2003 and 2004, and sudden cooling down in 2005 and 2006, also deserve a better explanation than the usual speculative bubble theory.

Related Links:

- Inflation, Politics and Government Intervention: How Asian Residential Markets Have Suffered (Nov 8, 2006)

- The global property housing boom (Oct 2, 2006)

- Is the global housing boom over? (Oct 20, 2005)