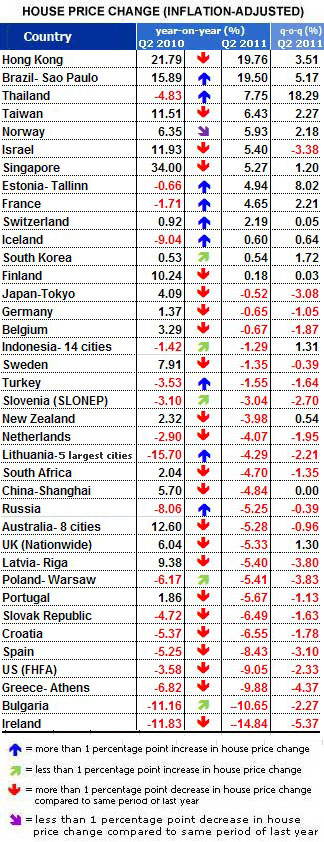

The world's housing markets were on balance weaker during the year ending in the second quarter of 2011, according to the first-ever published survey covering the Q2 2011 data, released today by the Global Property Guide, which traditionally publishes global housing data ahead of other research houses.

Housing markets were particularly weak in Europe and the US.

|

| Source: Various series, data descriptions and sources here |

Few European countries' markets rose, most fell, and many worse-hit countries such as Ireland, Greece and Spain performed even worse this year than last year. The US figures were also disappointing, due to high unemployment.

Globally, more housing markets experienced price falls than rises.

- Only 13 out of 39 countries which have so far released data for the period saw house price increases during the year to end Q2 2011.

- Out of 26 countries with house price falls, 18 saw accelerated rates of decline.

The Global Property Guide's statistical presentation uses price changes after inflation, giving a more realistic picture than the more upbeat nominal figures usually preferred by real estate agents.

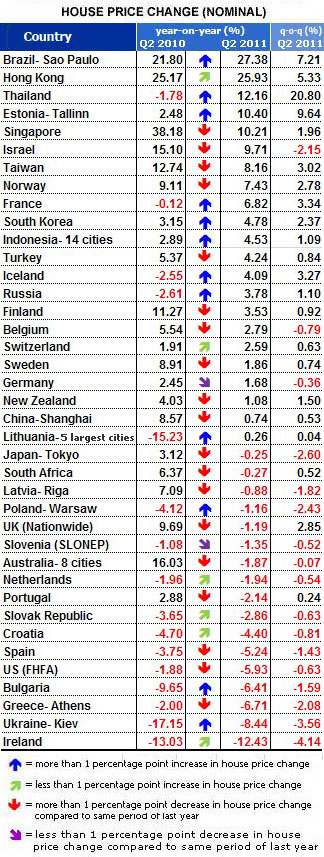

Nominal figures are shown in the second table.

Housing markets in some parts of Asia remain strong, despite government measures to cool price-rises

Hong Kong had the highest increase among all countries surveyed by the Global Property Guide, despite cooling measures implemented by the government. House prices were up 19.76% over the year to end Q2 2011, after inflation, with a quarterly rise of 3.51%.

The underlying dynamic has been Hong Kong's very strong economic growth, with GDP up 5.1% over a year earlier, and very low interest rates resulting from the Hong Kong dollar's peg to the US dollar.

In Thailand, single-detached houses rose impressively by 7.75% during the year to Q2 2011, after inflation, after last year's fall of 4.83%.

Thai house prices skyrocketed by 18.29% during the second quarter. This rise probably resulted from the zero interest loan scheme launched by the Government Housing Bank (GHB), aimed at increasing home ownership among lower and middle class earners. However, it should be noted that the Thai house price database is dated and unrepresentative.

|

| Source: Various series, data descriptions and sources here |

In Taiwan and Singapore, government curbs seem to have been effective. House prices in Taiwan rose by only 6.43% over the past 12 months (after a rise of 11.51% the previous year). In Singapore house prices rose by 5.27% (after a massive rise of 34% the previous year).

House prices in Japan (Tokyo) and China (Shanghai) are both weakening (falling by 0.52% and 4.84% year-on-year respectively).

US housing market alarmingly weak

US house prices fell 9.05% after inflation (a 5.93% decline in nominal terms) in the second quarter from a year earlier, the largest decline since 2009, according to the Federal Finance Housing Agency (FHFA). During the quarter, house prices dropped 2.33% after inflation (a fall of 0.63% in nominal terms).

US home values were pushed down by foreclosures, despite the lowest mortgage interest rates for over half a century. The homes for sale inventory averaged 3.7 million during the second quarter, the highest since Q3 2010, according to the National Association of Realtors (NAR).

The key factor driving US foreclosures is the continued high unemployment rate. During the second quarter, unemployment in the US stood at 9.1%.

Latin America's housing markets seem vibrant, but the data is weak

In only a few Latin American countries are house-price statistics published. Brazil had the second largest reported house price rises in the world year-on-year to end Q2 2011. House prices in Brazil have enjoyed double-digit growth over the past two years, according to the FIPE-ZAP price index.

In Sao Paulo, advertised property prices rose by 19.50% during the year to Q2 2011, with a rise of 5.17% during the second quarter of 2011. Factors boosting Brazil's real estate market include rapidly growing incomes and purchasing power, political and economic stability, an emerging middle class, and a growing population and availability of credit.

We would expect other countries where reporting institutions have not yet published their house price data (Argentina and Colombia) to reflect this upward trend when their Q2 figures appear. We also believe house prices have risen in other fast-growing Latin American countries (Peru), where (in contrast) no house price statistics exist.

European housing markets have been weak

Prices of houses in Europe generally fell lower during the year to the second quarter of 2011. In fact, most European countries experienced faster rates of decline than last year.

The data can be grouped into several categories: a) faster declines this year than last, b) recoveries last year which have turned into declines, c) continued declines, but not as severe as last year, and d) actual recoveries (a small category).

Several European countries which saw house price falls last year performed even worse this year

Ireland had the worst house price decline among all reporting countries in our survey over the twelve months to Q2 2011. House prices were down by 14.84% year-on-year, an even worse decline than the 11.83% fall the previous year.

European countries which experienced weaker performances than the previous year include Netherlands (-4.07%), Slovak Republic (-6.49%), Croatia (-6.55%), Spain (-8.43%) and Athens, Greece (-9.88%) (all figures inflation-adjusted).

Some European countries which recovered last year, sunk back this year

- In Latvia, standard type apartments in Riga fell by 5.40% year-on-year, after a solid comeback since Q2 2010. Quarter-on-quarter, apartment prices were down by 3.80%.

- In the United Kingdom, average house prices were down by 5.33% year-on-year, after rising 6.04% the previous year. The housing market began rebounding as early as Q4 2009, but started falling again in the last quarter of 2010. The price-falls in the UK are interesting, because UK interest rates have been low and sterling has fallen, attracting foreign buyers.

- In Sweden, house prices slid by 1.35% over the year to end Q2 2011, probably due to the 85% mortgage ceiling introduced last year.

- In Portugal, house prices have been falling since Q3 2010, and during the year to Q2 2011, prices dropped by 5.67%.

- In Germany, apartment prices have been slowing since the first quarter of 2011. During the full year to Q2 2011, prices dipped by 0.65%.

- In Finland, house prices rose, but were up a mere 0.18% year-on-year, down from 10.24% growth over the same period last year.

Other European countries which saw price falls last year, have continued to perform poorly this year, but in their case the rate of decline has decelerated.

- In Lithuania, apartment prices were down 4.29% over the year to end Q2 2011, a significant improvement than last year's fall of 15.70%.

- In Ukraine, apartment prices in Kiev were down 8.44% (in nominal terms) over the past twelve months, after plummeting by 17.15% the previous year.

- In Russia, prices in the secondary housing market were down 5.25% in the year to Q2 2011, after dropping by 8.06% the previous year.

- In Turkey, house prices were down by 1.55% from a year earlier, after last year's fall of 3.53%.

A few European countries have seen their housing markets recover

Norway led the small group of European countries which experienced house price increases, up by 5.93% over the year to end Q2 2011. Norway's housing market began to rebound in Q3 2009 and hasn't slowed, driven by low interest rates and strong economic growth (4.80% over a year earlier).

Housing markets in Estonia (Tallinn), France and Iceland rose during the year to end Q2 2011 after suffering house price falls in the previous year. In Tallinn, house prices were up 4.94% year-on-year, after last year's fall of 0.66%. In France (data is from FNAIM), prices of existing dwellings rose 4.65% year-on-year, after a fall of 1.71% the previous year. In Iceland, house prices rose slightly by 0.60% year-on-year, after plunging by 9.04% during the previous year.

After a decade-long decline during the 1990s, the housing market in Switzerland has been stable since 2000. During the year to Q2 2011, apartment prices rose by 2.19% year-on-year, up from 0.92% the previous year.

Israeli housing market softening

Israel house prices were up 5.40% year-on-year to Q2 2011, but the pace is slowing due to the steps taken by Bank of Israel. These include interest rate hikes (currently 3.25%) and the new limit on prime interest based mortgages (33% of the property's value).

During the second quarter, Israeli house prices fell by 3.38%, the steepest decline since the last quarter of 2008. Furthermore, the continued increase in the number of building starts, and steps taken by the Ministry of Finance in real estate taxation, are expected to be reflected in house prices in the course of the coming year.