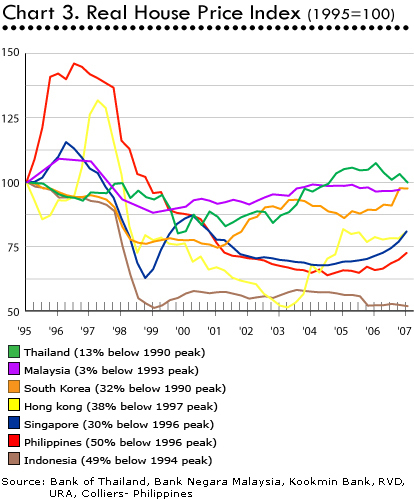

A decade after the 1997 Asian Crisis erupted, most housing markets in Asia are well on their way to recovery.

Boosted by strong economic growth and strong local and international demand, residential real estate prices in the Philippines, Singapore and South Korea rose by more than 10% in nominal terms y-o-y to Q1 2007.

Table 1. ANNUAL HOUSE PRICE CHANGE (%) Q1 2007 | ||||

| COUNTRY | NOMINAL | REAL | ||

| Singapore | 13.75 | 13.19 | ||

| Philippines | 14.29 | 10.04 | ||

| South Korea | 11.64 | 9.36 | ||

| Hong Kong | 5.18 | 2.75 | ||

| Indonesia | 5.69 | - 0.63 | ||

| Malaysia* | 2.10 | - 0.93 | ||

| Thailand | - 5.09 | - 6.98 | ||

| * Values for end-2006. Sources: URA, Colliers- Philippines, Kookmin Bank, RVD, Bank of Indonesia, Bank Negara Malaysia, Bank of Thailand | ||||

In Hong Kong, after registering price falls in early 2006, the over-all residential price index is back in positive territory. The index rose 5.2% y-o-y to March 2007. However this is significantly lower than the annual price increases to the first quarter of 2005 and 2004, at 21% and 28%, respectively.

Weak economic growth and high inflation are still weighing down on Indonesia's real estate market, although conditions are much better now. Meanwhile, political uncertainties in Thailand have led to a continued decline of the house price index.

National figures can be deceptive. Luxury condominiums in prime centres of Hong Kong, Bangkok, Kuala Lumpur and Jakarta have been appreciating strongly, despite bleak national house price figures.

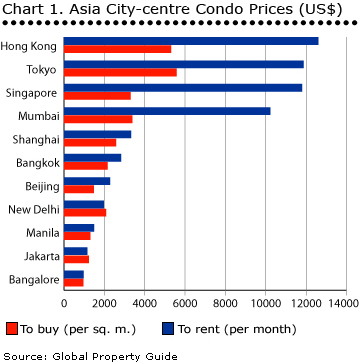

Residential condominium prices in Hong Kong, Singapore and Tokyo are still the most expensive in Asia, topping US$10,000 per square metre (sq. m.). On the other hand, luxury condos in Jakarta's central business district cost around US$1,200 per sq. m., according to Global Property Guide research.

No bubbles

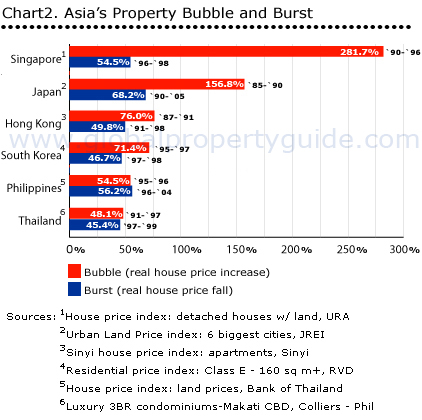

Although property prices in most Asian countries are still below their peak levels, rapid price appreciation has taken place over the past five years, leading to renewed fears that a speculative property bubble is forming in several Asian countries.

Table 2. FIVE AND TEN-YEAR HOUSE PRICE CHANGE (%) | ||||

| 2002 - 2007 | 1997 - 2007 | |||

| COUNTRY | NOMINAL | REAL | REAL | REAL |

| Hong Kong | 32.88 | 32.24 | - 39.95 | - 35.91 |

| Thailand | 32.12 | 14.01 | 37.48 | 4.22 |

| South Korea | 31.84 | 14.01 | 41.40 | 2.75 |

| Singapore | 17.77 | 13.44 | - 17.42 | - 21.87 |

| Malaysia* | 17.34 | 4.99 | 13.22 | - 3.07 |

| Philippines | 32.31 | 2.92 | - 11.79 | - 48.27 |

| Indonesia | 43.39 | - 5.30 | 109.25 | - 43.71 |

| * Values are for 2001 to 2006, and 1996 to 2006 Sources: URA, Colliers- Philippines, Kookmin Bank, RVD, Bank of Indonesia, Bank Negara Malaysia, Bank of Thailand | ||||

The fear is not unfounded; one has only to recall Asia's spectacular and disastrous property bubbles of the 1990s.

However, the recent price increases are actually recoveries from the previous slump caused by the Asian crisis and other phenomena. As of Q1 2007, property prices in most Asian countries are in fact still below their peak levels in real terms.

Strong Housing on Demand

Current economic and monetary conditions suggest continued strong demand for housing in countries affected by the Asian Crisis.

Income per person in all these countries is at on all time high. From 2001 to 2006, real income per person rose by 33% in Indonesia, 28% in Hong Kong, 24% in the Philippines and 20% in South Korea.

All economies affected by the Asian Crisis grew by 5% or more in 2006. GDP growth from 2002 to 2006 has been markedly stronger than during the crisis period (1997 to 2001), although slower compared to the tail-end of the 'Asian Economic Miracle'.

Table 3. AVERAGE ANNUAL GDP GROWTH RATE (%) | |||

| COUNTRY | 1992 - 1996 | 1997 - 2001 | 2002 - 2006 |

| China | 12.44 | 8.28 | 10.06 |

| India | 6.22 | 5.36 | 7.56 |

| Singapore | 9.12 | 4.36 | 6.12 |

| Malaysia | 9.56 | 3.04 | 5.64 |

| Thailand | 8.10 | -0.10 | 5.64 |

| Hong Kong | 5.30 | 2.84 | 5.58 |

| Philippines | 3.46 | 3.16 | 5.18 |

| Indonesia | 7.36 | 0.28 | 5.10 |

| South Korea | 7.34 | 3.92 | 4.80 |

| Taiwan | 6.98 | 4.08 | 4.46 |

| Source: IMF World Economic Outlook, April 2007 | |||

As a result of financial and monetary reforms implemented after the crisis, banks and other financial institutions are in much better shape now. Asia's mortgage market is set for a boom. This is despite the fact that mortgage lenders are more cautious of over-exposing themselves to particular sectors (some pundits worry that banks are actually being too cautious).

Despite recent interest hikes, in line with global interest rates, base interest rates for mortgage lending are generally lower now than before the crisis.

Table 4. BASE INTEREST RATE FOR MORTGAGES (%) | ||||

| COUNTRY | CURRENT LEVEL | PRE-CRISIS TROUGH | PEAK LEVEL | POST-CRISIS TROUGH |

| Hong Kong1 | 7.75 (Dec 06 - May 07) |

6.50 (Jul 92 - Feb 94) |

10.25 (Jan - Feb 1998) |

5.00 (Nov 02 - Aug 04) |

| Indonesia2 | 8.59 (May 07) |

15.71 (Dec 96) |

57.40 (Aug 98) |

7.47 (May 2004) |

| Malaysia3 | 6.72 (May 06 - May 07) |

6.83 (1994) |

12.27 (Jun 1998) |

5.98 (May 04 - Nov 05) |

| Philippines4 | 5.17 (May 2007) |

10.80 (Mar 1997) |

22.70 (Jan 1998) |

3.91 (Feb 2007) |

| Singapore5 | 5.33 (Aug 06 - May 07) |

5.34 (Oct - Nov 1993) |

7.79 (May - Aug 1998) |

5.30 (Mar 03 - Jul 06) |

| South Korea6 | 5.06 (May 2007) |

11.46 (Apr 1993) |

23.10 (Jan 1998) |

3.39 (Dec 2004) |

| Thailand7 | 7.00 (May 2007) |

10.50 (Jun 1994) |

15.50 (Mar - Aug 1998) |

5.75 (Aug 03 - Aug 05) |

| Notes and Sources: 1 Best lending rate (Hong Kong Monetary Authority) 2 Interbank lending rate - 3 months (Bank of Indonesia) 3 Base lending rate - Commercial banks (Bank Negara Malaysia) 4 364-day Treasury bill rate (Bangko Sentral ng Pilipinas) 5 Prime lending rate - 10 biggest banks (Monetary Authority of Singapore) 6 CD yields - 91 days (Bank of Korea) 7 Minimum loan rate - Siam Commercial Bank (Bank of Thailand) | ||||

Socio-economic conditions also point to continued strong demand for residential properties. Strong urbanization and population growth has led to high population densities in several Asian cities (see related article on housing markets in Asia).

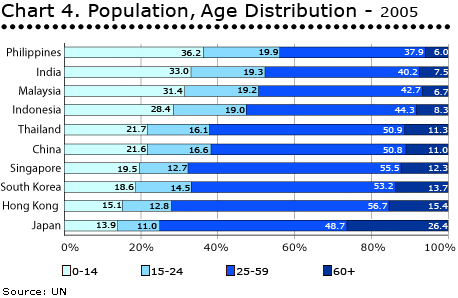

The demographic profile of several Asian countries is young, unlike most of developed Europe and Japan. In 2005, less than 15% of the total population in most countries was aged 60 or older; while children (0 - 14 years old) comprised 20% or more of the total population.

As the majority of population enters household formation age (generally between 25 and 40) demand for housing, both for owner-occupation and rental, will increase. Rapid wage and economic growth tend to lead to smaller household sizes, adding pressure to housing demand.

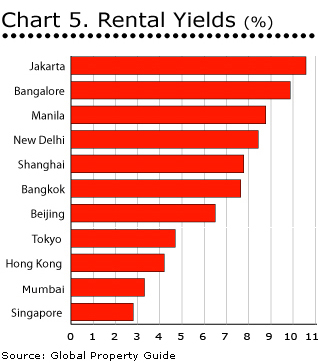

In view of the relatively restrained dwelling price rises, strong economic growth and banking sector caution and healthy yields to be enjoyed on properties in Asia, talk of another bubble seems far-fetched.

Other problems

A more pressing concern for Asian economies is the continuation of reforms to improve real estate efficiency and transparency. Transaction costs remain high and the property registration is still cumbersome in several countries.

In Malaysia, to revive the real estate market, foreigners can now buy properties worth MYR250,000 without the need for government approval. Malaysia has also abolished capital gains tax.

While Malaysia is encouraging foreign property buyers, Thailand's military junta is pushing them away. Thailand announced that it is completing a crackdown on foreign companies established for the sole purpose of buying landed properties. While the motivation for this move is unclear, the signal is clear 'foreigners are not welcome'. Political uncertainty and policy flip-flaps by the ruling junta are undoubtedly hurting the real estate market.

In the Philippines, proposed property market reforms are languishing in congress. These laws include the establishment of a centralized agency for registering property and a standard property valuation system.

Table 5. REGISTERING PROPERTY | |||

| COUNTRY | NUMBER OF DAYS | NUMBER OF PROCEDURES | COST (% OF VALUE) |

| China | 32 | 3 | 3.1 |

| Hong Kong | 54 | 5 | 5.0 |

| India | 62 | 6 | 7.8 |

| Indonesia | 42 | 7 | 10.5 |

| Japan | 14 | 6 | 4.1 |

| Malaysia | 144 | 5 | 2.4 |

| Philippines | 33 | 8 | 5.7 |

| Singapore | 9 | 3 | 2.8 |

| South Korea | 11 | 7 | 6.3 |

| Taiwan | 5 | 3 | 6.2 |

| Thailand | 2 | 2 | 6.3 |

| East Asia & Pacific | 85.8 | 4.2 | 4.0 |

| Source: Doing Business | |||