Tourism boom fuels Dominican Republic's property market

The Dominican Republic’s residential property market is growing fast, thanks to robust tourism growth and the arrival of luxury international and boutique hotels. In 2015, stay-over tourists rose by 8.9% to around 5.6 million, following an average annual growth of 5.2% from 2010 to 2014.

There are no restrictions on foreigners’ buying property in the Dominican Republic. “Tourists come for the surfing and the windsurfing, and many of them end up buying homes here too,” says Josefina Covents of the Cabarete-based agency Josefina Covents y Asoc.

Aside from its reputation as a tax haven and long stretches of sandy white beaches and a balmy temperature, foreign homebuyers are attracted because property is still a bargain, relative to the rest of the Caribbean. A newly-built one-bedroom apartment near a beach can be bought for just US$100,000 or less.

Foreign property investments are also encouraged by incentives, which according to the country’s tourism office, include:

- Tax-free receipt of pension income from foreign sources, including the possibility of moving belongings to the country, is guaranteed by Law 171-07 on Special Incentives for Pensioners and Persons of Independent Means.

- Foreign buyers receive a 50% exemption from property tax

- Exemption of taxes on the payment of dividends and interest, generated within the country or overseas

- Foreign buyers receive a 50% exemption on taxes on mortgages, when the creditors are financial institutions that are regulated by Dominican financial monetary law

- Exemption on payment of taxes for household and personal items

- Exemption from taxes on property transfers

- Partial exemption on vehicle taxes

- Developers are relieved of all national and municipal taxes for ten years, including the tax on the transfer of ownership to the first purchaser of a property, by Law 158-01 on Tourism Incentive.

A stable government, an improving infrastructure, and easy access via its three international airports further encourage foreigners.

However the surge in foreign property investors has been pushing prices upby an average of 10% every year since the global crisis, according to local real estate experts. Currently, prices for residential properties with an ocean view typically start at about US$100,000 while beachfront properties start as low as US$150,000.

At the high-end market, prices of luxury homes, which typically have an asking price of at least US$5 million, are stable, but in some areas, these prices are also rising robustly.

“The bottom has been hit and now, up it goes,” said Cesar Herrera Gutiérrez of Provaltur International, the exclusive affiliate for Christie’s International in the Dominican Republic.

The volume of luxury property transactions increased by around 10% last year, according to Sandy Parekh of Re/Max Coral Bay Realty. Despite this, it is “certainly nowhere near 2008."

The Dominican Republic also offers good rental yields, with some areas registering net rental yields as high as 10% annually, according to some local real estate experts.

What is on offer

The Dominican Republic's property market is very diverse. Prices at the lower end of the luxury market range from around US$100 to US$420 per square foot (sq. ft) for a prime oceanfront home, according to Parekh. Though, high-end residential property prices can go as high as US$5 million in the north and US$9 million in the south. The highest-priced home in the Dominican Republic is listed for US$25 million, ReMax's Parekh added.

In Santo Domingo, the country’s capital and largest city, the average price of a two- or three-bedroom house in the city center stands at around US$150,000. In recent years, luxury developments have been increasing along the coastal areas, making it the centre of high-end residential properties. Luxury beach villas in or near the capital city are priced as high as US$7 million.

In Puerto Plata, on the north coast, apartment prices have been rising by double-digit figures. Bigger apartments have showed the highest price appreciation. A 200 square metre (sq. m) apartment in upscale neighborhoods of Puerto Plata, like Sosua, costs around US$2,400 per sq. m.

In the Cabarete area, the price of an oceanfront condominium in a central location starts at about US$120,000, while a similar condo in a hotel-style development is priced from around US$250,000, according to Parekh.

Tourism-related developments include Amber Cove, the luxurious new Carnival Cruise Lines port-and-tourist village at Maimon, located just west of Puerto Plata, which finally opened in October 2015. Royal Caribbean is also planning to open a new port near Playa Dorada, between Puerto Plata and Sosua. Airlines have also started to increase their services into Puerto Plata International Airport as well as nearby Santiago International Airport.

The construction of major hospitality projects like Cap Cana, the Moon Palace Reort in Punta Cana, and San Souci Port in Santo Domingo are also expected to boost tourism.

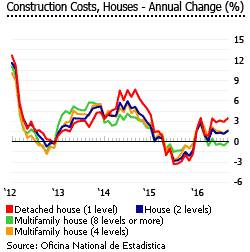

Despite the increase in house prices, construction costs have remained almost stable, mainly due to a decline in the prices of construction materials. In September 2016, the total construction costs for houses rose by 1.6% from a year earlier, after a decline of 0.9% in 2015, and annual increases of 3% in 2014 and 5.1% in 2013, based on figures from the Oficina National de Estadistica.

Though the Dominican Republic has its own currency, the peso, most real estate listings and transactions, especially of high-end properties, are quoted in U.S. dollars.

The Caribbean’s top tourist draw

The Dominican Republic has been the top vacation destination in the Caribbean since 2005, by a considerable margin, according to the World Bank.

- During the financial crisis of 2008-2009, the country’s tourism sector remained stable, with around 3.98 million and 3.99 million stay-over tourist arrivals, respectively, based on figures from the Caribbean Tourism Organization.

- In 2011, the country attracted more than 4.3 million stay-over visitors, up by 4.4% from a year earlier, despite weakness in the global economy.

- In 2012, tourism arrivals rose by 6% y-o-y to 4.56 stay-over million tourists

- In 2013, tourism arrivals rose 2.79% growth to 4.7 stay-over million tourists.

- In 2014, the country received around 5.14 million stay-over tourists, up by 9.6% from a year earlier, while the number of cruise ship passengers also increased 2.7% to 435,494 people over the same period.

- In 2015, non-resident stay-over tourists rose by 8.9% y-o-y to around 5.6 million,while cruise ship arrivals increased 21.5% to 528,999 people.

Tourism continues to grow strongly. From January to September 2016, the total number of stay-over arrivals in the Dominican Republic rose by 7.1% to 4,524,261 persons from the same period last year, according to the Caribbean Tourism Organization. Most tourists came from the United States, Canada, South America, France, Germany and other Caribbean nations.

The government aims to attract about 10 million visitors a year by 2023.

Foreign buyers rush to the coast

The Dominican Republic’s tourist developments are concentrated in the eastern and northern regions. Southern areas such as Barahona and Pedernales are less developed and less visited, but there have been efforts to promote them as eco-tourism destinations.

Punta Cana is the most popular tourist destination. Punta Cana’s international airport, situated in the country’s popular eastern region, received around 66% of all tourists traveling to the country in 2015.

Some of the most desirable residential areas are in tourist hot spots such as the capital, Santo Domingo, and the areas on the country’s beautiful Atlantic coast, such as the tourist towns of Sosua and Cabarete, the peninsula of Samaná, and Puerto Plata. Luxury beachfront apartments in places such as Punta Cana andBavaro, Las Terrenas and Boca Chica have been built in recent years.The Dominican Republic has a total population of just 10 million people and a GDP per capita of US$6,733 in 2015, according to the International Monetary Fund (IMF).

One of the most high-profile developments has been the Cap Cana project on the east coast, a high-end residential and tourist mixed development of hotels, oceanfront homes, golf courses and commercial establishments.

There was a crash - but that was then

Crash-induced foreclosures did not significantlyimpact the Dominica Republic's market, because most foreigners pay in cash.

Even so the global crisis did push prices down by about 20-25%, according to Alexandre Houisse of Coldwell Banker Coast to Coast Real Estate. New development projects fell by 70-80%, as a result of confidence crisis in the wake of global financial troubles, according to Parekh. “A lot of people that were going to develop projects put them on hold,” he said.

Economic growth slowed sharply to 3.1% in 2008 and 0.9% in 2009, in sharp contrast with real GDP growth rates of 8.5% in 2007, 10.7% in 2006, and 9.2% in 2005.

The property market is now growing strongly again, thanks to the boom in tourism and robust economic growth. In 2015, the economy grew by a spectacular 7%, after real GDP growth rates of 7.3% in 2014, 4.8% in 2013, 2.6% in 2012, and 2.8% in 2011, according to the IMF.

During the first half of 2016, the economy expanded by 7.4% from a year earlier, thanks to the continued strength in construction activities, according to the central bank.

The economy is expected to expand by a healthy 5.9% this year and by another 4.5% in 2017.

Shortage of affordable housing

The construction sector has accounted for more than 7% of the country’s GDP in recent years.However, most residential construction is aimed at the high-end market.

Because of this, the low-end market has been left behind with an acute shortage of low- to middle-income accommodation, and the country has a housing deficiency of around 600,000 units. Frequent hurricanes and flooding have exacerbated the shortage. The government recently pledged to expand social housing and build up to 40,000 new houses every year until 2023, with the help of the private sector.

Around 80% of all homes in the Dominican Republic are detached houses.

Developing the mortgage market

Most property transactions in the Dominican Republic are done in cash, because the country has a very small mortgage market. To help it, in 2012 the government enacted Law No. 189-11, the Law on Mortgage Market Development and Trusts, providing tax incentives and establishing the Trust as a legal instrument.

“The implementation of the Law for Development of the Mortgage Market and Trust is expected to help boost the sector in the medium- and long-term, and to mitigate the increased housing deficit in the country,” said Jorge Yanes of Fitch’s Latin America Group.

However in the last two years, more mortgages have been offered by local banks, typically, with a loan-to-value ratio of 70% of the appraised value of the property. Interest rates start at 8%.